How to Calculate Your COBRA Premium

Many hesitate to sign up for COBRA insurance, hearing about its high cost for continuing coverage. But rather than make assumptions or immediately resort to short-term or marketplace coverage, our COBRA calculator helps you estimate your monthly expense and compare extending your former employer’s group health plan to other available options.

Our COBRA Premium Cost Calculator determines an individual’s monthly premium based on a combination of their insurance deduction, the employer’s contribution and the pay frequency. Some employers might add an administrative fee, often up to 2% of the total premium. By analyzing these components, our COBRA cost calculator provides a breakdown of annual health insurance expenses.

Using this calculator, individuals during periods of employment transition can better project their upcoming healthcare expenses and budget accordingly.

Estimate Only

For an accurate quote on continuing your employer plan, please reach out to the COBRA plan administrator or consult the enrollment paperwork you received.

Calculate COBRA With Last Year’s W-2

Continue reading to find out how you can use last year’s W-2 to approximate your premium cost.

Calculate Your COBRA Premium

Managing a Gap in Health Insurance Coverage

Dealing with a gap in health coverage can be challenging, but temporary health insurance options can provide a safety net during transitions. Consider gap health insurance or short-term plans designed for those between jobs to ensure you remain covered.

These plans offer essential benefits and peace of mind while you secure long-term coverage. By comparing different plans, you can find one that meets your needs and budget, minimizing the risks associated with being uninsured. Act promptly to avoid lapses and protect your health and finances during this period.

Are You In Good Health?

Find Out How Much Your Monthly COBRA Premium Will Be

If you need to continue health coverage through an employer, the COBRA monthly cost is based on the full amount paid for health insurance under the original employer’s plan. This includes not only what was previously paid by the individual responsible for the insurance but also the employer’s contribution.

Look At Last Year’s W-2

Keep in mind that this calculation assumes that the cost structure remains the same after leaving the job and that the cost of your employer-sponsored health insurance didn’t change.

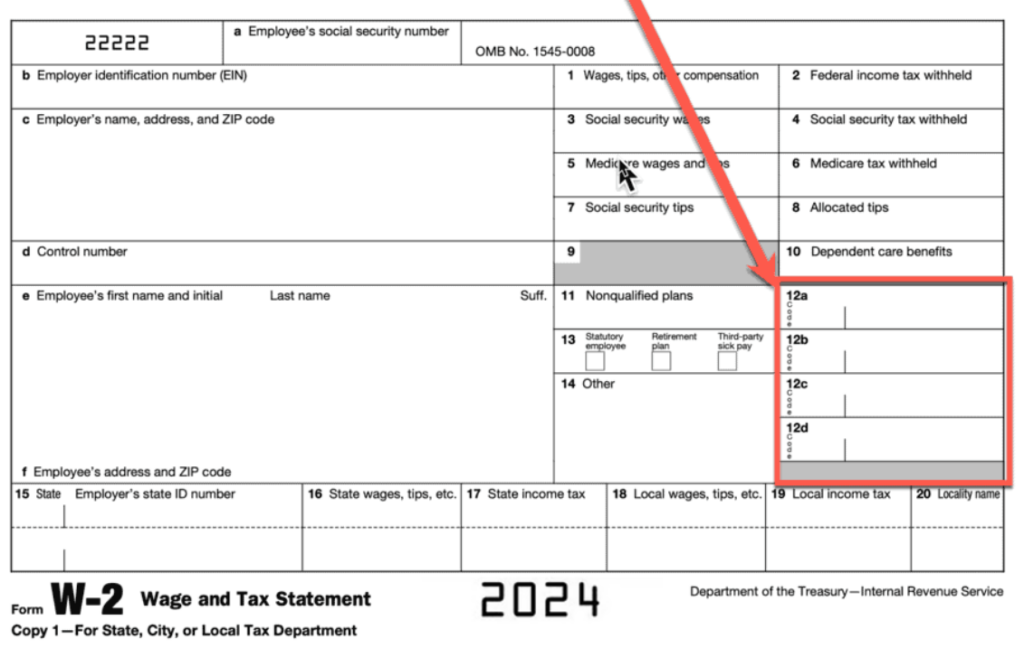

Find Box 12

On the W-2 form of the individual who was paying for the health insurance, Box 12 with Code DD represents the total cost of employer-sponsored health coverage. This amount includes both the part of the cost paid by that individual and the part paid by their employer. It can serve as a valuable starting point to determine the monthly COBRA cost for continuing coverage.

Here’s how you can use that information:

- Locate Box 12, Code DD on Your W-2: Find the amount listed under this code. This is the total annual cost of your health coverage.

- Divide by 12 for the Monthly Cost: Take the annual cost and divide it by 12 to find the monthly cost of your health insurance when you were employed.

- Add the Administrative Fee: COBRA allows for an administrative fee, usually up to 2% of the total premium cost. Calculate this fee and add it to the monthly cost.

Example:

- Box 12, Code DD Amount: $12,000 (annual cost)

- Monthly Cost Without Fee: $12,000 / 12 = $1000

- Administrative Fee: $1000 * 2% = $20

- Total Monthly COBRA Cost: $1000 + $20 = $1020

Getting The Exact Premium Cost of COBRA

To get an exact quote on continuing your employer plan, you should contact the plan administrator or refer to the COBRA enrollment paperwork you received regarding enrollment.

How Employers Calculate Health Insurance Costs for Employees

Employers negotiate group health insurance prices by discussing terms with insurance providers, considering factors such as the number of employees, overall health risks, and desired coverage levels. Once an agreement is reached, employers determine the cost to employees by assessing the company’s budget, the negotiated premium, and any intended subsidies. This cost is then often divided among employees, factoring in their pay grade, role, or tenure, resulting in a specified monthly premium deducted from their salaries.

The objective is to strike a balance between offering competitive benefits and managing the company’s financial health.

As a result of these factors, your COBRA premium will typically be higher than the amount previously deducted from your paycheck. Based on plan and state, COBRA costs range from about $400 to $700 per month and are based on the following:

- Your previous monthly insurance contribution.

- Your recent employer’s monthly insurance contribution. Along with your portion, this amount represents your group health plan’s full monthly premium previously paid to your insurance carrier.

- An administration fee of up to 2%, added for managing your COBRA plan.

Was this answer helpful?

Share this article:

Only $11.95/ month

- 24/7 Access to Care

- Affordable and Cost-Effective

- Wide variety of health services

- Prescription Refills

Frequently Asked Questions About COBRA Insurance Costs

Below are some common questions and answers to help you understand how COBRA costs are calculated and what to expect when estimating your premium.

How is the cost of COBRA determined?

COBRA premiums include both the amount you paid for health insurance as an employee and the portion your employer contributed, plus an administrative fee of up to 2%.

Can I use my W-2 to estimate my COBRA premium?

Yes, by using Box 12, Code DD from your W-2, you can determine the total annual cost of your employer-sponsored health coverage and calculate the monthly premium.

How do I add the administrative fee to my COBRA cost?

Multiply your monthly premium by 2%, then add that amount to your monthly cost to account for the administrative fee.

How can I get an exact COBRA premium?

To get an exact premium, contact your plan administrator or refer to your COBRA enrollment paperwork.